Businesses operating under GST regulations need to include specific information on their invoices, such as HSN/SAC codes. With Invoice Crowd's new Table Format feature, creating GST-compliant invoices is now streamlined through table formats rather than a separate GST toggle.

Steps to Create GST-Compliant Invoices

Set Up a GST Table Format

Log in to your Invoice Crowd account.

Navigate to Business Profiles in the left sidebar.

Select the business profile you want to customize.

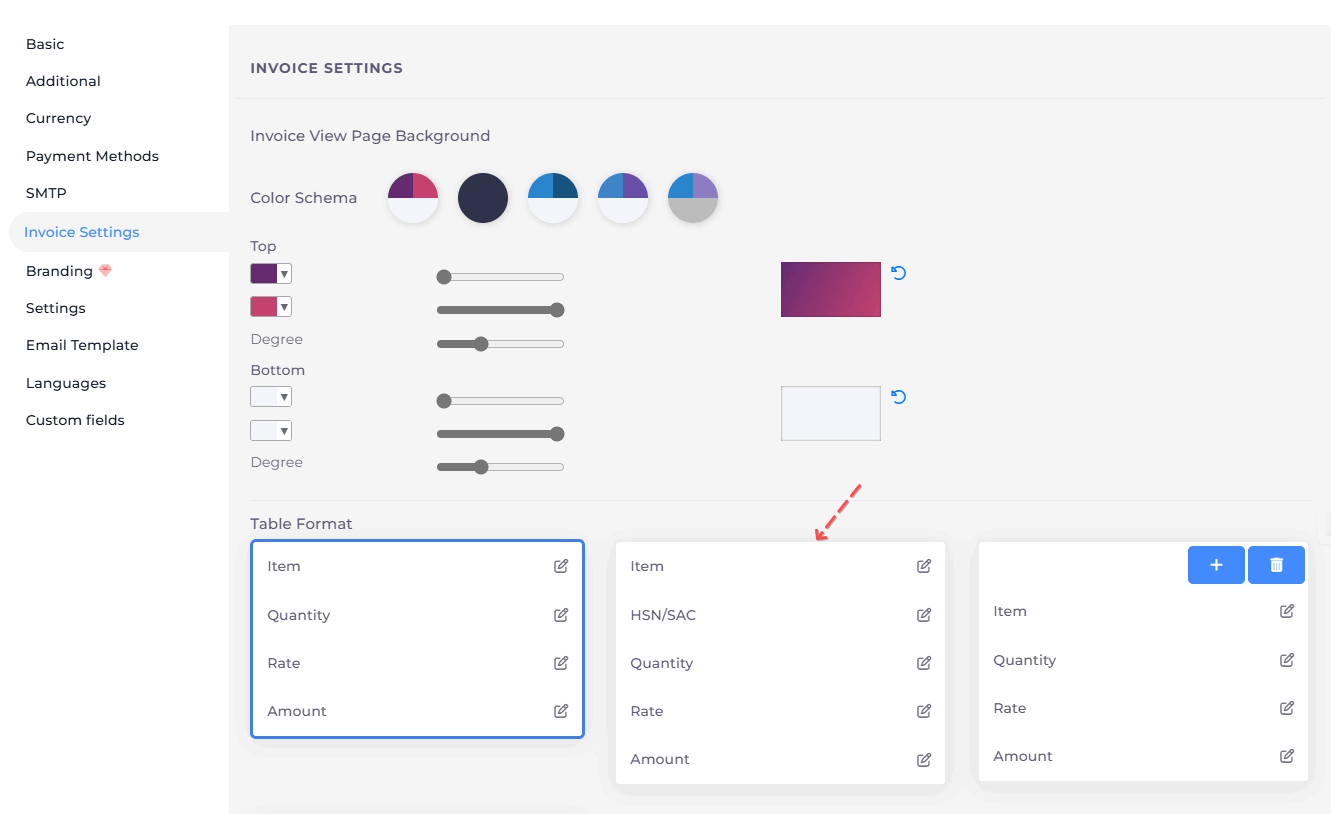

Click on Invoice Settings in the left sidebar.

Scroll down to find the Table Format section.

Select "With GST" as your base format.

Customize the columns as needed for your business requirements.

Set GST Table Format as Default (Optional)

If most of your invoices require GST compliance, you can set the GST table format as your default.

In the Table Format section, select your preferred GST table format.

save your settings.

All new invoices will now use this GST-compliant format by default.

Creating a GST Invoice

Navigate to Invoices in the left sidebar.

Click on Create Invoice.

The invoice will use your default table format, you can also select a format manually.

Selecting a GST Table Format for Individual Invoices

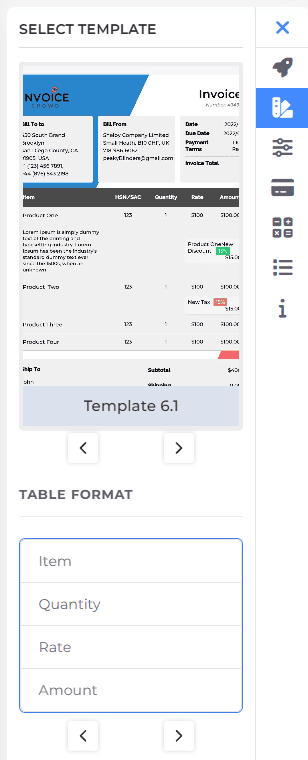

While creating or editing an invoice, look for the settings panel on the right side.

Under the templates section, you'll find the table format option.

Select your GST table format from the list.

The invoice will update to show the HSN/SAC column and other GST-related fields.

Adding HSN/SAC Codes to Invoice Items

With a GST table format selected, each line item will now include an HSN/SAC field.

Enter the appropriate HSN/SAC code for each product or service.

These codes will be displayed on the final invoice for GST compliance.

Previewing and Sending Your GST Invoice

After adding all necessary information, preview your invoice to ensure all GST details appear correctly.

Send the invoice to your client through your preferred method.

Note: The previous method of enabling GST through a toggle button has been phased out in favor of this more flexible table format approach. This new method allows for greater customization while maintaining compliance with GST regulations.